Automate Cash Application with Intelligent Matching

Transform your AR workflow with AI-powered payment-to-invoice matching that reduces manual reconciliation by up to 90%, even for complex scenarios like TDS deductions and split payments.

See how our intelligent matching engine can transform your AR process in just 30 minutes.

The Problem

Manual Cash Application Is Costing You More Than You Think

Traditional cash application processes drain resources, introduce errors, and create bottlenecks that impact your entire finance operation.

The Hidden Costs of Manual Cash Application

Your finance team spends countless hours manually matching payments to invoices.

Human error leads to misapplied payments and reconciliation headaches.

Delayed processing extends Days Sales Outstanding (DSO) and tightens working capital.

Unmatched transactions slow down month-end closing and distort financial reports.

TDS deductions, partial payments, and batch transfers create persistent matching nightmares.

Manual reconciliation is time-consuming and prone to errors.

Did You Know?

Every dollar in working capital represents 15-20% potential growth opportunity cost

Companies with automated cash application see a 70-90% reduction in processing time

How It Works

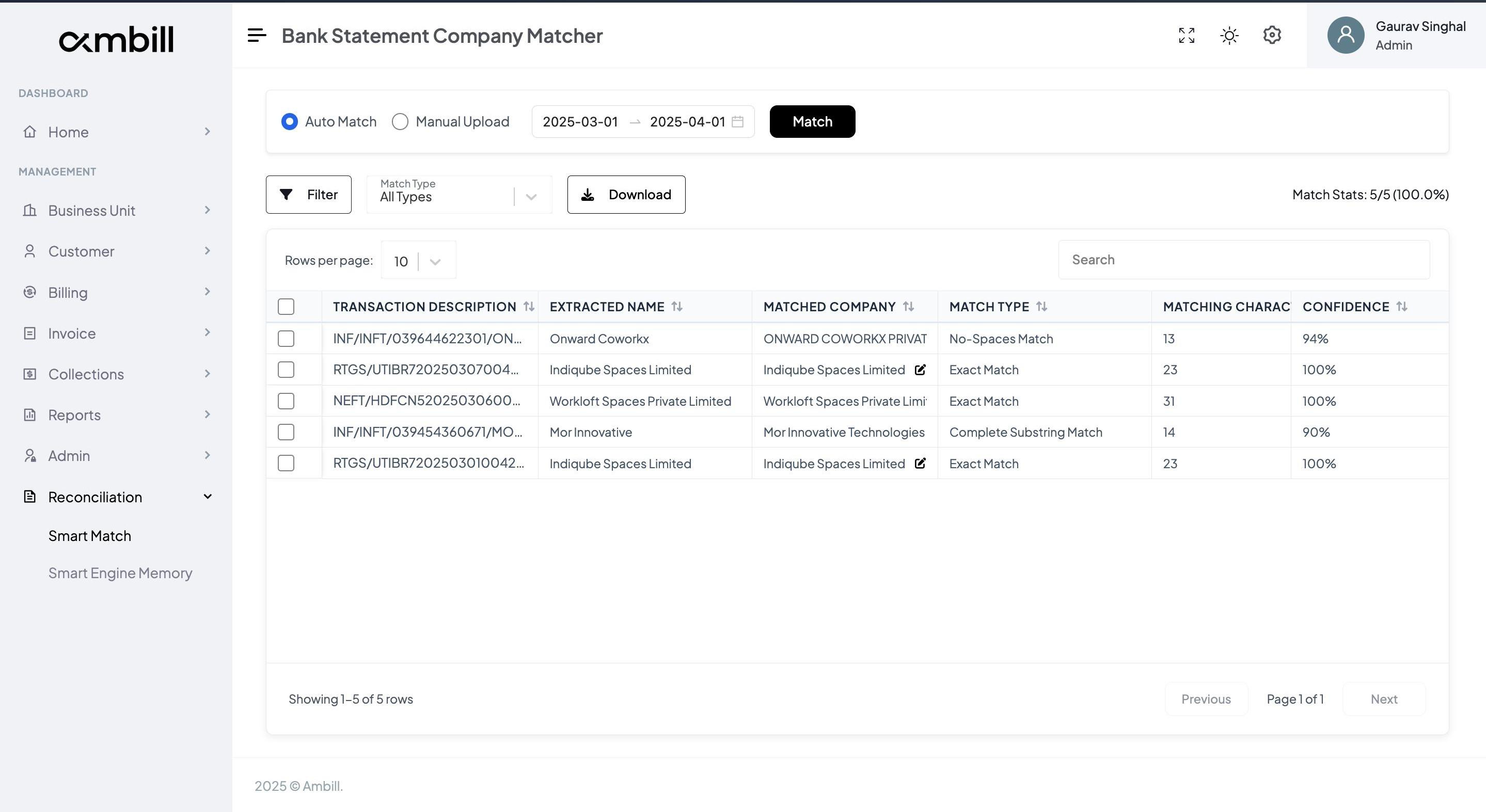

Intelligent Matching That Handles Even Your Most Complex Scenarios

Our Cash Application Automation solution uses sophisticated algorithms to seamlessly identify matches between incoming payments and outstanding invoices.

Data Ingestion

Seamlessly imports payment and invoice data from your existing systems, bank statements, and payment gateways.

Intelligent Matching

Our engine applies multiple matching strategies concurrently for direct 1:1, TDS-aware, split payment, and multi-invoice scenarios.

Diagnostic Tools

Any exceptions or unmatched transactions are flagged, with smart recommendations provided for swift resolution.

Continuous Learning

The system learns from each transaction to improve future matching accuracy and automatically posts reconciled entries.

Data Ingestion

Seamlessly imports payment and invoice data from your existing systems, bank statements, and payment gateways.

- Bank statement imports (CSV, MT940, BAI2)

- Direct API connections to banking partners

- Secure payment gateway integration

- Real-time data synchronization

See your own data in action with a personalized demonstration.

Who Can Benefit

Designed for Businesses with Complex Payment Environments

Our automated solution delivers exceptional value for a diverse range of industries, particularly those dealing with complex payment scenarios.

Manufacturing Companies

Efficiently manage high-volume transactions and diverse payment terms.

Technology Service Providers

Seamlessly handle subscription models and usage-based billing.

Professional Services Firms

Manage retainers, milestone payments, and hourly billing with precision.

Wholesale Distributors

Process high transaction volumes with accuracy, regardless of varying payment terms.

Indian Businesses

Specifically designed to manage TDS deductions across various transaction types.

Companies with Global Operations

Easily reconcile payments across multiple currencies and diverse payment methods.

Ideal For Your Business If:

Processing 200+ transactions monthly

Dealing with TDS or other tax deductions

Facing challenges with partial payments

Spending significant time on manual reconciliation

Key Benefits

Transform Your AR Process from Cost Center to Strategic Asset

Our cash application solution delivers substantial benefits across efficiency, accuracy, and financial metrics.

Reduce Manual Work by 90%

Free up your finance team to focus on high-value, strategic activities.

Improve Accuracy to 99%+

Eliminate human error and ensure payments are correctly applied.

Reduce DSO by 3-5 Days

Improve cash flow and optimize working capital.

Handle Complex Scenarios

Process TDS deductions, split payments, partial payments, and more with ease.

See The Potential ROI For Your Business

Calculate how much you could save by automating your cash application process.

Complete Solution

Complete Your AR Transformation

Enhance the value of Cash Application Automation by pairing it with other Ambill features for end-to-end AR excellence.

Cash Application

- AI-powered matching

- TDS-aware processing

- Split payment handling

- Continuous learning

Invoice Automation

Streamline the entire process from invoice generation to receipt of payment

Learn moreGet Started

Transform Your Cash Application Process in Weeks, Not Months

Join forward-thinking finance teams who have reduced manual cash application by 90%, improved accuracy, and accelerated cash flow.

Schedule a Personalized Demo

Experience the system using your own data and see immediate benefits.

Full Implementation Support

Our dedicated team assists you throughout the setup process to ensure a smooth transition.

Rapid Results

Witness noticeable improvements within the first payment cycle.

Ready to Transform Your Cash Application Process?

Join the forward-thinking finance teams who have reduced manual cash application by 90%, improved accuracy to 99%+, and accelerated cash flow.

Customer Success Stories

Real Results from Real Businesses

"Before Ambill, we had two full-time employees dedicated solely to cash application. Now, 92% of our payments are matched automatically, allowing us to reallocate those resources to more strategic projects."

No obligation. See how it works with your own data.